Running News Daily

Running News Daily is edited by Bob Anderson. Send your news items to bob@mybestruns.com Advertising opportunities available. Train the Kenyan Way at KATA Kenya and Portugal owned and operated by Bob Anderson. Be sure to catch our movie A Long Run the movie KATA Running Camps and KATA Potato Farms - 31 now open in Kenya! https://kata.ke/

Index to Daily Posts · Sign Up For Updates · Run The World Feed

Grand Slam Track: Big Ambitions, $40 Million in Debt, and a Hard Lesson for the Sport

When Grand Slam Track launched last year, it promised something track and field had long been missing: guaranteed pay, a league structure, and an alternative to the shoe-company–dominated model that has defined the sport for decades.

Now, new bankruptcy filings reveal just how steep the climb really was.

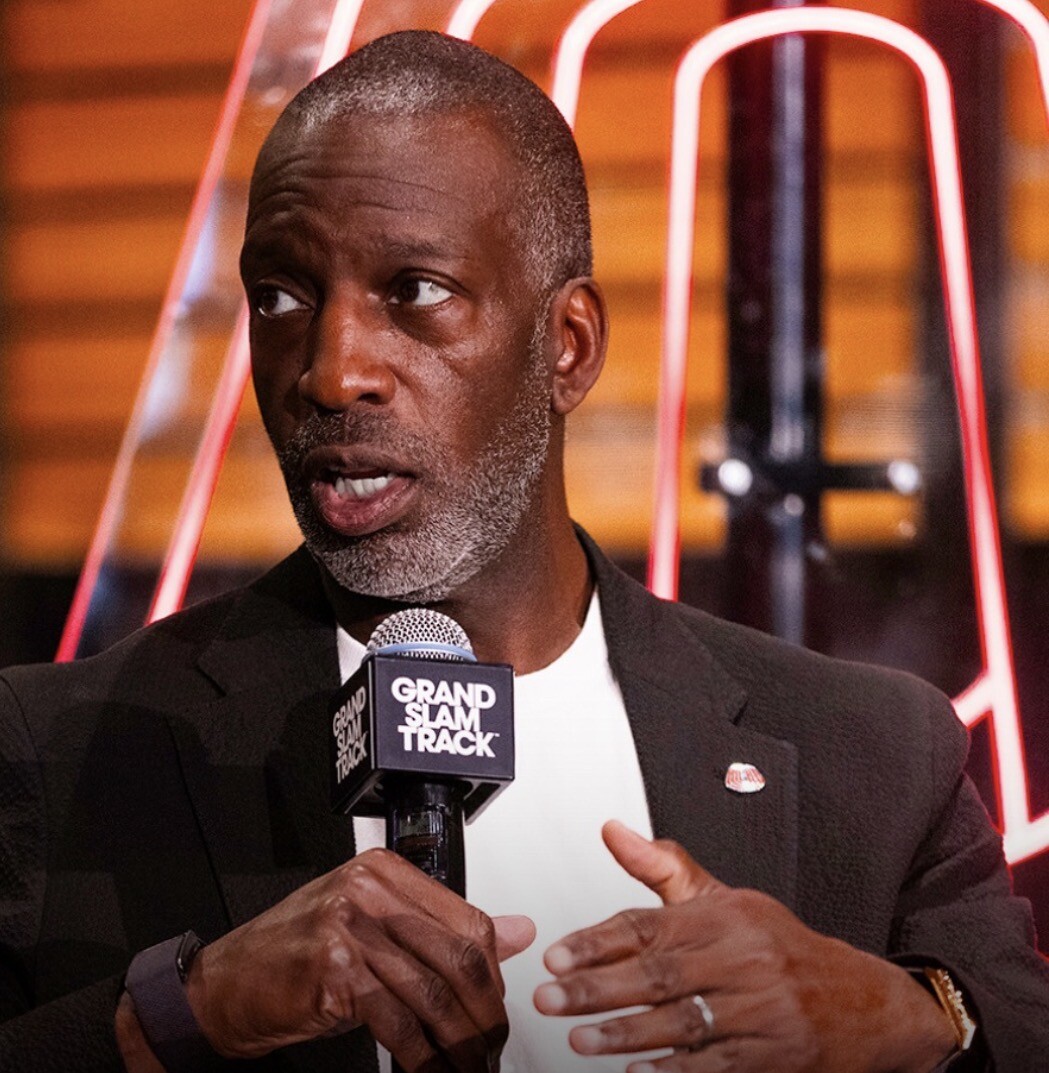

According to documents filed in Delaware Bankruptcy Court, the league generated only $1.8 million in revenue during its inaugural season—while accumulating more than $40 million in debt. The filings offer the clearest financial picture yet of the troubled league founded by Olympic champion Michael Johnson, and they show liabilities roughly $10 million higher than Grand Slam previously disclosed.

A Costly First Season

Grand Slam Track staged three meets last spring—in Miami, Philadelphia, and Kingston—but struggled to generate meaningful revenue beyond ticket sales. While the Miami and Philadelphia events drew respectable crowds, attendance in Kingston was so low that tickets were reportedly given away.

The league’s decision not to accept shoe-company sponsorships, combined with the cost of producing its own broadcasts, placed enormous pressure on cash flow. Despite early optimism, Grand Slam was unable to attract major sponsors or sell lucrative media rights.

For comparison, Athlos, a single-meet event backed by Alexis Ohanian, reportedly generated millionsin revenue in its second year, while the startup women’s basketball league Unrivaled brought in $27 million in its first season, largely through media deals—even while operating at a loss.

Grand Slam, by contrast, entered bankruptcy with less than $1 million in assets.

The Bankruptcy Filing

Grand Slam filed for Chapter 11 bankruptcy in December, rather than Chapter 7 liquidation, meaning the league technically still has a chance to restructure and return. The filing followed the league’s inability to fully pay athletes and vendors from its inaugural season.

Court documents show:

• Total liabilities: approximately $40.6 million

• Total revenue in 2025: $1.8 million

• Assets: under $1 million

The league is currently operating under debtor-in-possession (DIP) financing, a high-interest loan structure that allows companies to continue operating during bankruptcy.

Winners Alliance: The Central Backer

The dominant creditor—by a wide margin—is Winners Alliance, the for-profit arm of the Professional Tennis Players Association, chaired by hedge-fund billionaire Bill Ackman.

Winners Alliance has played multiple roles:

• Lead investor in Grand Slam’s seed round

• Organizer of an eight-figure emergency financing package in fall 2025

• Sole provider of DIP financing

Altogether, Winners Alliance is owed more than $17 million, accounting for roughly 40% of Grand Slam’s total liabilities.

Other notable creditors include:

• HLS Holdings (Robert Smith): $1 million

• APL Ventures (Albert P. Lee): $300,000

• Share Ventures (Hamet Watt): $250,000

• Vivek Padmanabhan: $250,000

• Brittany Ann Nohra: $200,000

Operational debts include:

• Over $350,000 owed to a W Hotel in Los Angeles

• $350,000 to track surface company Rekortan

• $340,000 to American Express

Athletes Caught in the Middle

Grand Slam’s salary model—once hailed as revolutionary—ultimately became one of its biggest vulnerabilities.

After an investor withdrew from an eight-figure term sheet following the Kingston meet, Johnson later acknowledged the league faced a “major, major cash-flow issue.” Emergency financing allowed athletes to receive only half of what they were owed, while vendors rejected similar settlement terms.

Several top athletes—including Cole Hocker, Alison Dos Santos, Josh Kerr, and Masai Russell—are still under multiyear contracts with approximately 250 days remaining, according to court filings. The league has stated it intends to use part of its emergency funding to sign new contracts and chart a possible path forward.

What This Means for Track and Field

Grand Slam Track’s collapse does not invalidate the idea behind it—but it does underline the realities of building a professional league in a sport with limited commercial infrastructure.

Track remains largely dependent on:

• Shoe-company sponsorships

• Appearance fees

• Prize money tied to championships and major road races

Grand Slam tried to change that model overnight. The ambition was admirable. The financial runway was not.

The Road Ahead if there is one

Later this week, Grand Slam is expected to file its Chapter 11 reorganization plan, outlining how it intends to restructure its debts and whether it can realistically return.

Whether the league survives or not, its rise and fall will leave a lasting mark on the sport—forcing hard conversations about sustainability, athlete compensation, and what it truly takes to build a viable professional track league.

For now, Grand Slam Track stands as a cautionary tale: bold vision alone is not enough. In track and field, as in racing itself, pacing matters.

by Boris Baron

Login to leave a comment